WGBH Shows Growth

In 2011, when WGBH made changes, they were roundly criticized. At the end of 2011 WGBH split off its news service and created a separate classical and music service on WCRB. There were loud complaints from WBUR about diluting the NPR news audience. There were complaints from long-time classical listeners. WCRB's signal was much weaker than WGBH's. Many in the system doubted WGBH's move, wondering if the news market in Boston could support two NPR stations. For its part, WGBH came to the conclusion they could no longer be a viable public media operation being all things to all people on one signal.

So what happened? Early results were not encouraging. Audience figures did not show growth. Despite the fact that looking at early results is unreliable, many thought it proved the point that WGBH had made a huge mistake.

Taking the Long View

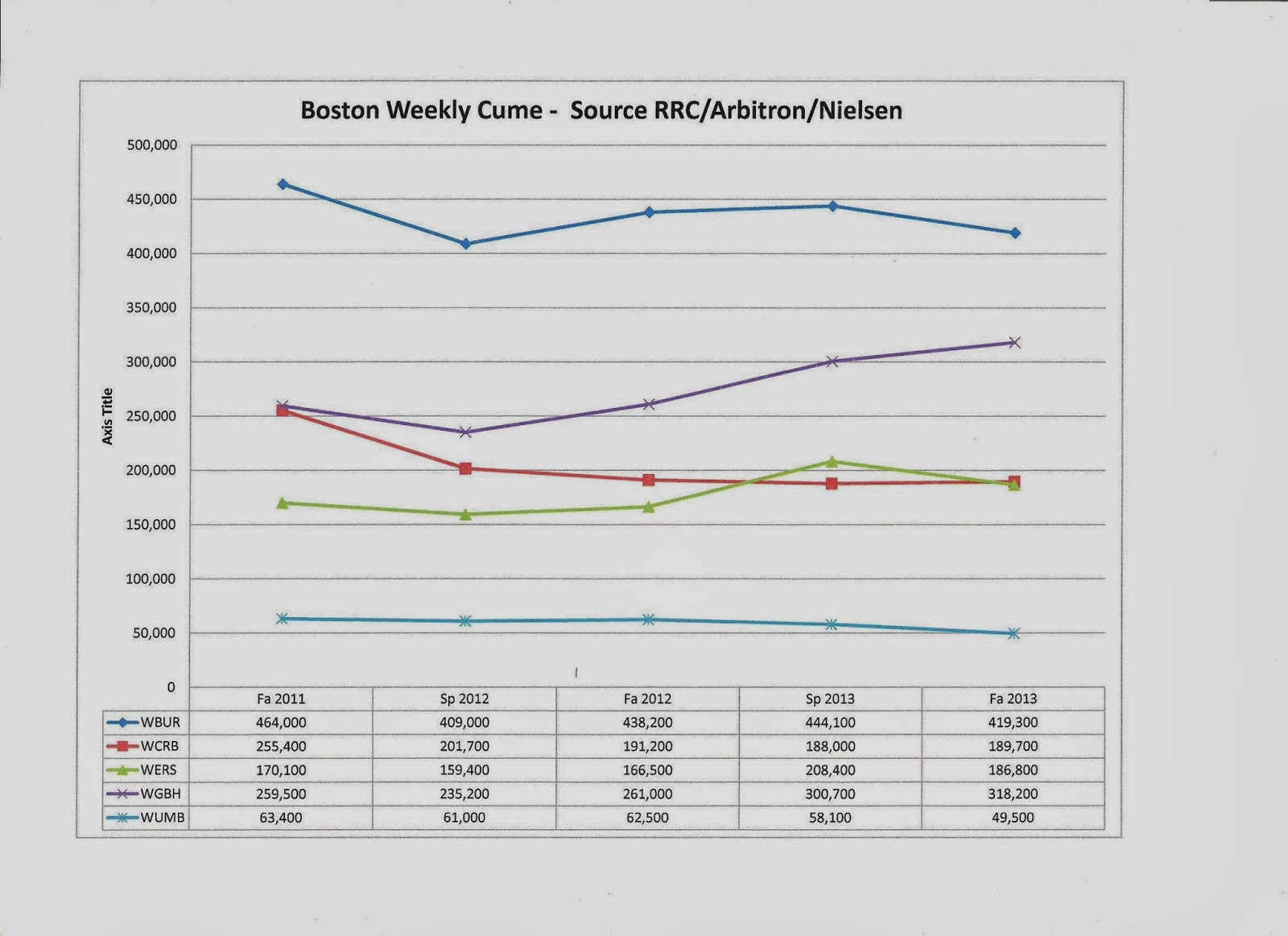

It has been over two years since the change. Enough time has elapsed to get an idea of audience trends. The results are mixed. WGBH is showing growth. WCRB (the station with the weaker signal) is not showing growth. Looking at topline figures for five public radio stations using Fall and Spring Quarter data starting with the Fall Quarter from 2011 to the present you can get a sense of where things have gone in Boston. WBUR is holding onto its share of the Boston audience. WGBH is growing its average audience, share and cume. WCRB is declining in all three metrics. WERS, with its eclectic music programming, has a large weekly cume but, they have a very high turnover ratio. WUMB continues to bump against the bottom. Whatever they're doing isn't having much of an effect on the audience. I worked at WUMB for a short while at the end of 2010 and the start of 2011. Audience figures are pretty much the same as they were back then.

WGBH saw the need for change. Despite criticism and negative feedback, they are beginning to see postive results.

Steel Yourself

Change is something I'm familiar with. I helped shepherd two changes at WNPR. The first came in 1989 when WNPR took control of its programming in the morning. The phone calls and letters from contributors were sharply critical. The press was negative. Letters to the editor ran heavily against the changes. The results were positive with growth in audience and member dollars. In 2006, when the format changed to include more news and information, the feedback was more intense. The Hartford Courant devoted a front page article with a banner headline to the change. The article was not positive. It lamented the loss of classical music and, at the same time, included a sidebar with a list of eight other stations in the market that still carried the genre. Over 4,000 complaints came in from members. Major donors were bending the ear of the CEO. He had his doubts about the change from the beginning. The complaints reinforced his doubts.

Before the change we did our homework. We measured the effects the change would have on our membership by splitting them into groups called imperatives. They were News Imperatives, Crossover Imperatives, and Classical Imperatives. In our survey, we paid particular attention to what would happen to the Crossover Imperative. We already knew the News Imperatives would be supportive. And, we knew the Classical Imperatives would leave us. The question was, "Would the Crossover Imperatives remain in sufficient numbers to sustain our membership dollars over the short term?” The answer seemed to be yes. Still, there was some uncertainty. When contemplating the change it is important to understand that the reaction from many contributors will be negative. They contribute because they like the station the way it is.

It takes courage to make changes in public radio. The onslaught of complaints wilted some including senior management. My performance review that first year was blistering.

A Positive Outcome

In the first year our audience grew and became more loyal. Membership dollars remained stable. The number of members decreased slightly. Our corporate and foundation support grew 500 percent!

Contemplating change? It takes research, planning and courage.

In the end, the Boston market may be robust enough to support competition for the Public Radio Audience.

The data below is from RRC, Arbitron and Nielsen. I've used AQH Persons, AQH Share and Weekly Cume to give a sense of the trends.

In 2011, when WGBH made changes, they were roundly criticized. At the end of 2011 WGBH split off its news service and created a separate classical and music service on WCRB. There were loud complaints from WBUR about diluting the NPR news audience. There were complaints from long-time classical listeners. WCRB's signal was much weaker than WGBH's. Many in the system doubted WGBH's move, wondering if the news market in Boston could support two NPR stations. For its part, WGBH came to the conclusion they could no longer be a viable public media operation being all things to all people on one signal.

So what happened? Early results were not encouraging. Audience figures did not show growth. Despite the fact that looking at early results is unreliable, many thought it proved the point that WGBH had made a huge mistake.

Taking the Long View

It has been over two years since the change. Enough time has elapsed to get an idea of audience trends. The results are mixed. WGBH is showing growth. WCRB (the station with the weaker signal) is not showing growth. Looking at topline figures for five public radio stations using Fall and Spring Quarter data starting with the Fall Quarter from 2011 to the present you can get a sense of where things have gone in Boston. WBUR is holding onto its share of the Boston audience. WGBH is growing its average audience, share and cume. WCRB is declining in all three metrics. WERS, with its eclectic music programming, has a large weekly cume but, they have a very high turnover ratio. WUMB continues to bump against the bottom. Whatever they're doing isn't having much of an effect on the audience. I worked at WUMB for a short while at the end of 2010 and the start of 2011. Audience figures are pretty much the same as they were back then.

WGBH saw the need for change. Despite criticism and negative feedback, they are beginning to see postive results.

Steel Yourself

Change is something I'm familiar with. I helped shepherd two changes at WNPR. The first came in 1989 when WNPR took control of its programming in the morning. The phone calls and letters from contributors were sharply critical. The press was negative. Letters to the editor ran heavily against the changes. The results were positive with growth in audience and member dollars. In 2006, when the format changed to include more news and information, the feedback was more intense. The Hartford Courant devoted a front page article with a banner headline to the change. The article was not positive. It lamented the loss of classical music and, at the same time, included a sidebar with a list of eight other stations in the market that still carried the genre. Over 4,000 complaints came in from members. Major donors were bending the ear of the CEO. He had his doubts about the change from the beginning. The complaints reinforced his doubts.

Before the change we did our homework. We measured the effects the change would have on our membership by splitting them into groups called imperatives. They were News Imperatives, Crossover Imperatives, and Classical Imperatives. In our survey, we paid particular attention to what would happen to the Crossover Imperative. We already knew the News Imperatives would be supportive. And, we knew the Classical Imperatives would leave us. The question was, "Would the Crossover Imperatives remain in sufficient numbers to sustain our membership dollars over the short term?” The answer seemed to be yes. Still, there was some uncertainty. When contemplating the change it is important to understand that the reaction from many contributors will be negative. They contribute because they like the station the way it is.

It takes courage to make changes in public radio. The onslaught of complaints wilted some including senior management. My performance review that first year was blistering.

A Positive Outcome

In the first year our audience grew and became more loyal. Membership dollars remained stable. The number of members decreased slightly. Our corporate and foundation support grew 500 percent!

Contemplating change? It takes research, planning and courage.

In the end, the Boston market may be robust enough to support competition for the Public Radio Audience.

The data below is from RRC, Arbitron and Nielsen. I've used AQH Persons, AQH Share and Weekly Cume to give a sense of the trends.